If your competitors shifted strategy tomorrow, would your team catch it before it hit your bottom line?

For most companies, the honest answer is probably not.

Despite operating in a data-rich era, competitive analysis is still treated as a side task performed occasionally, interpreted narrowly, and often used reactively.

Though praised as a pillar of business strategy, competitive analysis remains one of the most misunderstood and underutilized tools in the executive arsenal. In many organizations, it’s less a strategic function and more a checkbox on the planning calendar, creating the illusion that they’ve covered their bases. But what they end up with is a hollow sense of awareness. Teams walk away feeling informed but act on incomplete, surface-level clarity. They’re gathering data but not gaining insight.

Traditional models weren’t designed for the breakneck speed, layered complexity, and fluid competition of today’s AI-fueled markets. They often miss the subtle forces that shape strategic advantage: brand equity, customer advocacy, operational precision, digital traction, and narrative control.

CEOs who rely on outdated competitor matrices risk misjudging threats, missing hidden opportunities, and steering their companies based on assumptions rather than actionable insights. It’s like surveying a battlefield with binoculars when what you really need is a command center. Binoculars might help you spot movement, but they can’t reveal intent, map shifting terrain, or coordinate your response. A command center offers the full picture, including real-time updates, predictive insights, and a clear view of where to strike and where to defend.

In this blog, we’ll explore why it’s time to retire the binoculars and embrace the command center and why Battleboard™ is the strategic cockpit today’s CEOs need to navigate, outpace, and outthink the competition in real-time.

Table of Contents

- Traditional Competitor Analysis: An Overview

- Identifying Competitors: Who’s in the Arena?

- The Competitive Comparison Checklist and Its Shortcomings

- Limitations of Traditional Competitor Analysis

- Beyond the Usual: Dimensions That Deserve a Seat at the Table

- How ImpelHub Conducts Competitive Analysis

- How ImpelHub Conducts Competitive Analysis

- Mapped Across Major Strategic Categories

- Battleboard™ Top 5 Competitive Analysis Presentation

- NextMove: Turning Insight into Actionable Strategy

- Case Study: Health Supplement Brand

- Battleboard™ vs. Traditional Frameworks: A Comparison

- The Cognitive Impact of Battleboard™’s Visualization on Strategic Decision-Making

- Conclusion: Why Act Now

- FAQ

Traditional Competitor Analysis: An Overview

At its core, competitor analysis is about understanding who you’re up against and how your brand stacks up strategically, operationally, and emotionally. It traditionally involves identifying competitors, analyzing their product offerings, pricing, marketing strategies, and customer experiences, and ultimately assessing where you stand in relation.

On paper, this sounds comprehensive. However, in practice, most traditional analyses are akin to peering at the horizon with a pair of binoculars, providing a limited, fixed-angle view rather than a 360-degree operational picture.

Let’s walk through the foundational components of how traditional competitor analysis is structured:

Identifying Competitors: Who’s in the Arena?

Before you can understand your position in the market, you need to identify who else is in the arena. The common approach begins by categorizing competitors into a few distinct types:

- Direct Competitors: Businesses that offer the same or nearly identical products or services, targeting the same customer segment with similar value propositions. These are the ones your customers actively compare you against.

- Indirect Competitors: Companies that solve the same core problem but through different methods or technologies. They may not be on your radar today, but they could influence customer expectations tomorrow.

- Legacy Competitors: Long-standing players with deep brand equity, trust, and established distribution. These companies can shape industry standards even if they’re no longer the most innovative.

- Emerging or Disruptor Competitors: New entrants leveraging novel technology or business models. Often underestimated, these brands move fast and carve out new market categories before incumbents can react.

While this segmentation is a necessary starting point, one critical issue is often overlooked: scope management. In digital-first markets, the list of potential competitors can balloon into the hundreds. The goal isn’t to monitor everyone; it’s to monitor the right ones deeply and continuously.

And this is where most teams stall: they stop at identification. They build a list but fail to build context. True competitive strategy doesn’t stop at recognizing who’s out there; it starts when you understand their intent, track their evolution, and evaluate their impact on your positioning and your future.

The Competitive Comparison Checklist and Its Shortcomings

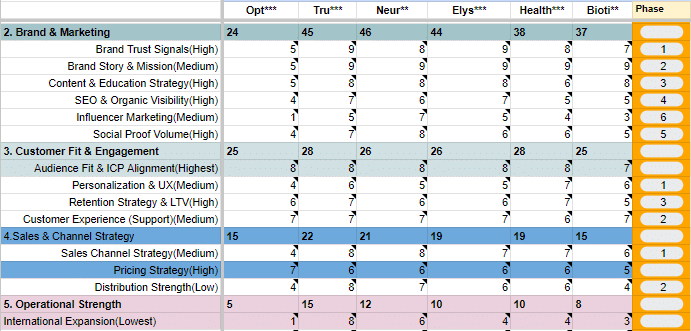

Once competitors are identified, most traditional teams shift to the comparison phase, usually via a multi-dimensional competitive analysis matrix like the one shown above. This matrix rates each competitor, along with your own brand, across attributes such as product features, pricing, content strategy, logistics, customer reviews, and visibility in organic and paid channels.

These analyses are usually built manually and pieced together from internal team knowledge, public data, and online research. Tools like Excel, Google Sheets, or static slide decks remain the go-to formats. To supplement, many teams pull signals from platforms like Similarweb, SEMrush, BuiltWith, or Crayon. While these tools offer valuable data, they are often tacked onto a conventional process, not embedded into a living strategy system.

And that’s where the problem lies.

These models give the illusion of structure but often lack strategic depth. It tells you what your competitors are doing but not why, how well, or what to do next. It’s like analyzing troop formations from yesterday’s battlefield to plan today’s attack. The terrain has already shifted, new players have entered the field, and your opponents are on the move while your team is still reviewing last week’s intel.

Traditional Frameworks for Data Analysis

Traditional analytical frameworks have long provided structured ways to interpret strategic and market data. Some directly address competitors, while others shape how businesses understand the competitive landscape. They’re still valuable, but they have constraints in today’s fast-moving business environment.

SWOT Analysis

SWOT (Strengths, Weaknesses, Opportunities, and Threats) is a commonly used framework in competitive analysis. It helps businesses assess their own position and their competitors’ potential impact. However, it’s often limited to a point-in-time reflection. In volatile markets, strengths today may be irrelevant tomorrow. And without quantification, SWOT assessments easily fall prey to internal biases.

Competitor Profiling

In theory, competitor profiling offers deep insight into a rival’s brand DNA. In practice, many teams reduce profiling to surface-level data: funding amounts, headcount, or a few press mentions. Done right, this should resemble psychographic profiling for companies, not just a data sheet.

Perceptual Mapping

Perceptual maps visually plot customer perceptions of various brands across selected axes (e.g., price vs. quality, innovation vs. usability). They help identify whitespace opportunities or oversaturated zones. However, their value depends entirely on the accuracy and freshness of the input data. Outdated or overly subjective perception data can lead to misleading visualizations.

Porter’s Five Forces

Porter’s Five Forces framework evaluates industry attractiveness based on supplier power, buyer power, competitive rivalry, threat of new entrants, and substitutes. It’s a classic for assessing structural market dynamics, but it’s not designed for tracking real-time evolution or short-term disruption caused by startups or pivots.

PESTEL Analysis

PESTEL (Political, Economic, Social, Technological, Environmental, Legal) helps teams zoom out and evaluate the broader context. While insightful for regulatory or societal shifts, it lacks the granularity needed for day-to-day competitive maneuvering. Moreover, it’s rarely updated frequently enough to reflect dynamic market signals.

Limitations of Traditional Competitor Analysis

Even with solid frameworks, traditional competitive analysis suffers from inherent limitations:

- Manual and Slow: Gathering and analyzing data takes weeks, often making the insights obsolete by the time they’re reviewed.

- Subjective and Inconsistent: Without standardized scoring, internal bias and interpretation skew results. Two teams can assess the same competitor and reach entirely different conclusions.

- Surface-Level Insights: Most efforts stop at features and pricing. They miss the strategic intent behind competitor moves.

- Incompatible with Fast Markets: Traditional models can’t keep pace with sectors where product launches, funding rounds, and viral trends reshape landscapes in days.

- No Prioritization Logic: Frameworks like SWOT list problems but don’t rank them. Teams are left guessing what matters most.

- No Ongoing Visibility: Reports are created quarterly or annually, lacking a feedback loop to track evolving threats or opportunities.

What is rarely discussed is how traditional frameworks fail to connect market intelligence to operational strategy. They identify gaps but don’t say what to do about them.

You wouldn’t navigate a modern battlefield with hand-drawn maps. Why are so many businesses still using one to plot their competitive strategy?

Beyond the Usual: Dimensions That Deserve a Seat at the Table

To modernize competitive analysis, strategic teams should incorporate overlooked but high-impact factors that reveal not just what a competitor is doing but why and how well. While some of these factors may vary in relevance by industry, they represent a powerful toolkit for deeper competitive insight.

1. Hiring Trends and Job Descriptions

Emerging hiring patterns can hint at product roadmap directions, regional expansions, or new technology bets.

2. Customer Sentiment Velocity

Instead of just collecting star ratings or reviews, track the tone and velocity of customer feedback over time. Are they getting more negative or positive? Are complaints increasing in a specific product line?

3. Narrative Positioning & Content Momentum

What themes are competitors leaning into? How frequently are they updating their messaging? Are they shifting focus from “features” to “transformation”? Content tracking tools can help you reveal how brand storytelling is evolving.

4. Feature Adoption vs. Feature Availability

Most teams compare product features based on checklists. But what matters more is which features customers are actually using and raving about. Look at changelogs, community forums, and feature request boards to spot what’s sticking, not just what’s shipped.

5. Partner Ecosystem Growth

Is the competitor expanding partnerships, integrations, or alliances? Growth here often signals ecosystem plays, platform strategies, or indirect GTM expansions. These alliances can quietly reshape market positioning before they’re reflected in sales.

These hidden indicators provide sharper insight into strategic intent, operational momentum, and future positioning. But manually piecing them together is tedious, error-prone, and disconnected from real-time change.

That’s why static analysis isn’t enough anymore. What today’s CEOs need is a smarter, integrated way to measure competitive movement, not once a quarter, but continuously.

That’s where ImpelHub’s Battleboard™ comes in as your always-on competitive command center.

How ImpelHub Conducts Competitive Analysis

In a market where hundreds of companies can look similar on the surface, ImpelHub’s approach begins with a sharper question:

Who are the few competitors that actually matter to your growth, and what should you do about them?

At the center of ImpelHub’s methodology is CounterEdge, a system powered by FoeScan, its proprietary competitor intelligence engine. Unlike generic comparisons, FoeScan blends strategic filtering, algorithmic scoring, and human validation to turn competitor data into action-ready strategies.

CounterEdge—Powered by FoeScan

FoeScan begins by systematically scanning your competitive landscape, not based on guesses or shortcuts, but through a proprietary multi-factor algorithm. Each potential competitor is assessed across 10 core similarity dimensions, such as product or service offerings, target audience, company size, geographic reach, industry, etc.

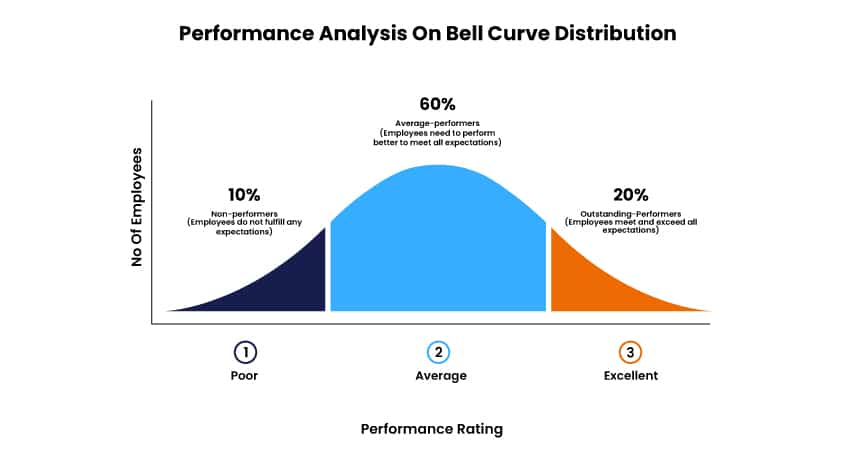

But it doesn’t stop at listing names. These dimensions are weighted, scored, and plotted across a bell curve as shown above to filter signal from noise:

- Left tail (10%) – Irrelevant or non-threatening players

- Middle bulk (60%) – Moderate competitors to be observed

- Right tail (Top 20%) – Strategic rivals that demand action

The result is a refined shortlist of your top 5 competitors, those most similar, most active, and most likely to influence your trajectory. You then validate this list in a client review checkpoint to align the algorithmic output with real-world context.

From Competitor Moves to Countermoves

After FoeScan identifies the most relevant competitors, it shifts focus to their top strategic plays and what they’re doing in the market to win attention, revenue, or loyalty.

ImpelHub then uses its internal database, trend analysis, and manual verification to decode these competitive strategies and generate custom counter-strategies based on:

- The competitive threat each brand poses

- Your relative strengths and vulnerabilities

- Market gaps they’ve missed

What makes CounterEdge powerful is its focus on relevance and impact. It observes and evaluates how competitor actions affect your business and where your response should focus.

With key rivals mapped and countermoves generated, the groundwork is set for Battleboard™, ImpelHub’s dynamic strategy board.

Battleboard™: Strategy Mapping Across 20+ Dimensions

Knowing your top competitors is step one. But knowing where you stand against them, dimension by dimension, strategy by strategy, is where real competitive clarity begins. That’s exactly what ImpelHub’s Battleboard™ delivers.

Battleboard™ is a precision strategy mapping tool designed to benchmark your business against your top competitors across more than 20 industry-specific dimensions, helping you understand exactly where you stand, why it matters, and what to do next.

It offers a single, unified view of your brand’s performance that goes far beyond feature comparison or surface-level benchmarking. Instead, it reveals:

- Where your business leads, lags, or has room to win

- Which competitors pose the greatest strategic threat

- Which levers to pull to sharpen your advantage

Mapped Across Major Strategic Categories

Every industry is different, but the principles of strategic differentiation are constant. Battleboard™ organizes its analysis across a list of core categories tailored to your market. Here are some examples.

- Product & Innovation – Are you delivering differentiated, scalable solutions?

- Brand & Marketing – Is your story resonating louder and clearer than your rivals’?

- Customer Fit & Engagement – Are you aligned with the right audience and keeping them engaged?

- Sales & Channel Strategy – How strong is your distribution engine and sales efficiency?

- Operational Strength – Can your business deliver consistently and scale sustainably?

Within each category, your brand is benchmarked against competitors across specific dimensions, scored on a 0–10 scale, each backed by a clear rationale and supporting data.

But here’s what sets Battleboard™ apart: you’re not just a spectator. You’re part of the scoring process. ImpelHub invites you to validate or adjust scores based on your internal insight so the final picture reflects both external data and your organizational intelligence.

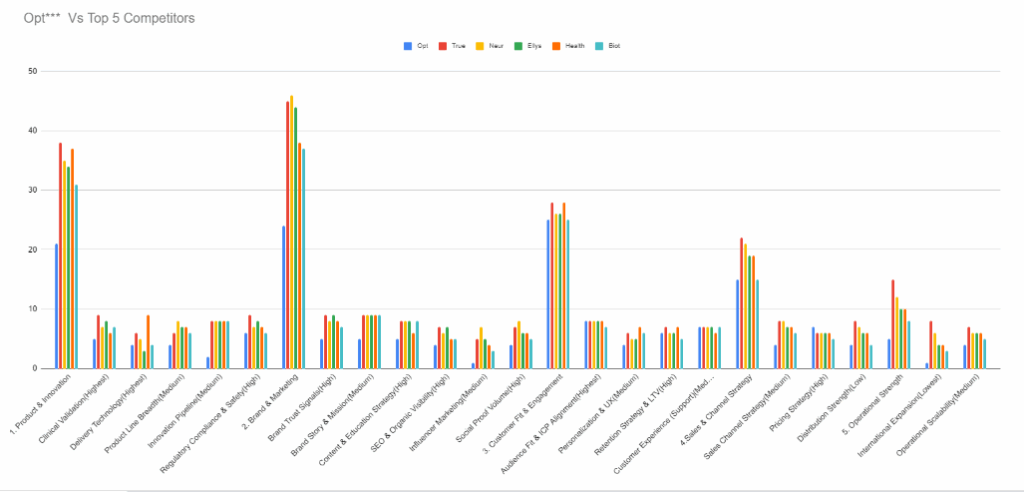

Battleboard™ Top 5 Competitive Analysis Presentation

To make the data actionable, Battleboard™ distills all dimensions into a visual head-to-head comparison, putting your brand and your top five competitors side by side.

This isn’t just about who’s ahead in features or marketing spend. It’s a multi-dimensional view of competitive performance across categories that matter. Each score is enriched with impact insights, so you’re not just seeing where you differ but how much it matters.

The above graph illustrates:

- How your brand performs across 20+ strategic competitive dimensions

- Where your advantage is strong, weakening, or at risk

- Which categories present the greatest opportunities for strategic growth

It’s the kind of analysis that translates easily across teams without needing to interpret 40-page decks or scattered spreadsheets.

It’s the difference between glancing at the battlefield through binoculars and stepping into a live command center. Binoculars might show you who’s nearby. But a command center reveals how fast they’re moving, which direction they’re heading, and where you’re exposed. That’s what Battleboard™ brings to the table.

With your true position now visible, it’s time to act. And that’s where NextMove begins, scoring and prioritizing the smartest strategies for growth based on data, impact, and innovation.

NextMove: Turning Insight into Actionable Strategy

With positioning established and gaps identified, the next challenge is clarity: Which counter-strategies are worth pursuing? Which ones will actually move the needle?

NextMove tackles this head-on by evaluating every counter-strategy using two core metrics that reflect both performance potential and strategic boldness.

NextMove Evaluation Criteria | Description |

Impact Score (1–10) | Measures the potential effect of a strategy on key business metrics such as revenue growth, cost reduction, market reach, and efficiency. Higher scores indicate strategies likely to produce significant, measurable results. |

Innovation Score (1–10) | Assesses the uniqueness, scalability, and market-disrupting potential of a strategy. The more innovative and differentiated, the higher the score. Scores can be weighted to reflect your business priorities for tailored evaluation. |

Prioritization Process | After scoring, NextMove uses bell curve analysis and standard deviation to identify the top 16% of strategies that balance strong impact with high innovation. These become the prioritized strategic initiatives ready for execution. |

Case Study: Health Supplement Brand

ImpelHub worked with a health supplement brand struggling in a saturated market. Traditional competitor lists weren’t helping.

Client Overview and Challenge

TreatLyme, a specialist brand focused on Lyme disease support, faced a 40% revenue drop following Google’s SEO algorithm changes. The impact was worsened by fragmented platforms that disrupted user experience and weakened SEO performance.

Solution:

ImpelHub led the strategic transformation of TreatLyme by leveraging its AI-driven competitive analysis while collaborating with Virtina.

- Consolidated platforms into a unified content-commerce site to enhance user experience and search performance.

- Optimized SEO strategies to recover visibility and boost organic traffic.

- Integrated community insights from LymeUnited to strengthen engagement and brand relevance.

- Introduced AI-powered personalized supplement recommendations tailored to individual needs.

- Launched loyalty programs aligned with brand policy constraints for sustainable retention.

The Results:

- Revenue Stabilized: Initial recovery achieved with long-term growth potential.

- Improved Organic Traffic: Boosted visibility through optimized product pages and content.

- Streamlined Operations: Easier management through platform unification.

- Scalable Growth Foundation: Positioned for future innovation and expansion.

Customer feedback praised the brand’s personalized supplement recommendations and tangible health benefits, highlighting the success of a data-driven, customer-focused strategy.

Battleboard™ vs. Traditional Frameworks: A Comparison

Feature | Traditional Frameworks | ImpelHub Battleboard™ |

Purpose | Conceptual understanding | Actionable, data-backed insights |

Scope | Broad strategic themes (strengths, market forces, etc.) | 20+ industry KPIs across five or more strategic categories |

Speed | Slow, manual | Real-time, automated |

Objectivity | Analyst-dependent | Standardized scoring metrics |

Update Frequency | Quarterly or yearly | Continuous updates and real-time monitoring |

Data Depth | High-level overviews but limited granularity | Strategic, granular insights |

Visualization | Text-heavy, conceptual diagrams | Interactive dashboards and visual scoreboards |

Prioritization | No inherent prioritization system | Bell curve and weighted scoring to highlight top strategic moves |

Collaboration | Static documents with limited input | Users can annotate, validate, and refine scores collaboratively |

Outcome | Strategic reflection | Strategy generation and execution planning |

The Cognitive Impact of Battleboard™’s Visualization on Strategic Decision-Making

Traditional competitor analysis frameworks often rely on static data and dense reports that are difficult to interpret and rarely revisited. Battleboard™, on the other hand, leverages dynamic, interactive visualizations to align with how modern executives absorb and act on information.

Here’s how Battleboard™ enhances strategic thinking:

- Engages Cognitive Processes More Effectively: Interactive visuals stimulate pattern recognition and spatial reasoning, core strengths of the human brain, leading to faster and deeper insight comprehension.

- Reduces Cognitive Overload: Instead of wading through spreadsheets or slide decks, decision-makers get a clear, intuitive view of multi-dimensional data.

- Improves Decision Speed and Accuracy: Visually structured data enables executives to act faster and more confidently, with clarity on where the brand leads or lags.

- Fosters Cross-Functional Alignment: A shared visual language enables multiple teams (marketing, product, leadership) to understand and act on the same strategic reality, breaking down silos.

- Enables Ongoing Strategic Refinement: Unlike traditional frameworks that are used once and forgotten, Battleboard™ is built for real-time updates, acting as a living tool that evolves with the market and your business.

By making insights visible, collaborative, and actionable, Battleboard™ shifts competitor analysis from a static reporting exercise to a high-impact, real-time strategic discipline.

Conclusion: Why Act Now?

Traditional competitor analysis no longer meets the demands of today’s fast-paced, AI-driven, and hyper-competitive markets. CEOs need clarity, not clutter. They need real-time insights, automated prioritization, and cross-functional visibility to stay ahead.

ImpelHub’s Battleboard™ is a strategic shift. It transforms how organizations understand competition, make decisions, and execute with confidence. It reveals not just what your competitors are doing but why it matters, how it impacts your position, and what you should do next.

Now is the time to stop relying on static models and start acting on dynamic intelligence.

If you’re ready to lead with sharper clarity, smarter strategy, and faster execution through real-time, data-driven insights, Battleboard™ isn’t just an upgrade you need; it’s the edge you can’t afford to miss.

FAQ

1. What is ImpelHub Battleboard™?

Battleboard™ is ImpelHub’s AI-powered competitive positioning engine that maps your brand and key competitors across strategic business vectors like pricing power, innovation, product depth, go-to-market speed, and customer sentiment. It turns fragmented market data into an interactive, real-time grid that guides CEOs and CMOs on where to play and how to win.

2. Who should use Battleboard™?

Battleboard™ is designed for CEOs, CMOs, Heads of Strategy, Product Marketing Managers, and Growth Teams who want a live, strategic cockpit instead of static reports. It’s ideal for B2B companies navigating crowded or fast-evolving markets where traditional SWOTs and quarterly market reviews fall short.

3. How is Battleboard™ different from traditional competitor analysis?

Unlike traditional competitor grids or SWOT reports that are often subjective, outdated, or siloed:

- Battleboard™ uses data from multiple internal and external sources.

- It scores competitors using AI-generated impact and innovation metrics.

- It integrates with tools like FoeScan™, FanScope™, and NextMove™ for automated strategy recommendations.

- It’s visual and dynamic, not static PDFs or slides.

4. How often is competitive data updated in Battleboard™?

Battleboard™ is continuously updated with the latest available data. Depending on the data source:

- Market trends and digital signals (like ad spend, SEO rankings, press mentions) are updated daily to weekly.

- CRM and internal win/loss data can be synced in real-time or on custom schedules.

You get a dynamic, always-on overview, not a snapshot every quarter.

5. Can Battleboard™ integrate with my existing tools?

Yes. Battleboard™ supports integrations with:

- CRM platforms like Salesforce and HubSpot

- Business intelligence tools like Tableau and Looker

- Marketing tech like SEMrush, Similarweb, and LinkedIn Insights

- Custom APIs for proprietary data streams

This ensures no disruption to your existing workflows, just a smarter, faster layer of strategy.

6. Is Battleboard™ only for large enterprises?

No. While built for enterprise-grade strategy, Battleboard™ also benefits mid-sized and growth-stage companies looking to scale intelligently. Its modular setup allows smaller teams to start with a core stack and grow as needed.

7. How does Battleboard™ help CEOs make better decisions?

It gives CEOs:

- A real-time strategic dashboard showing where the company stands

- Proactive alerts when a competitor launches or pivots

- AI-prioritized actions through the NextMove™ module

- Confidence to move faster, backed by data, not gut instinct